Over the last couple of years, the Franchising Code of Conduct has increased the disclosure obligations on franchisors. However, franchisors have always had to make sure that, in simple terms, they deliver what they promise to franchisees.

Under the Australian Consumer Law, franchisors can be liable where they engage in misleading or deceptive conduct – which can include promising an amount of start-up costs without a reasonable basis.

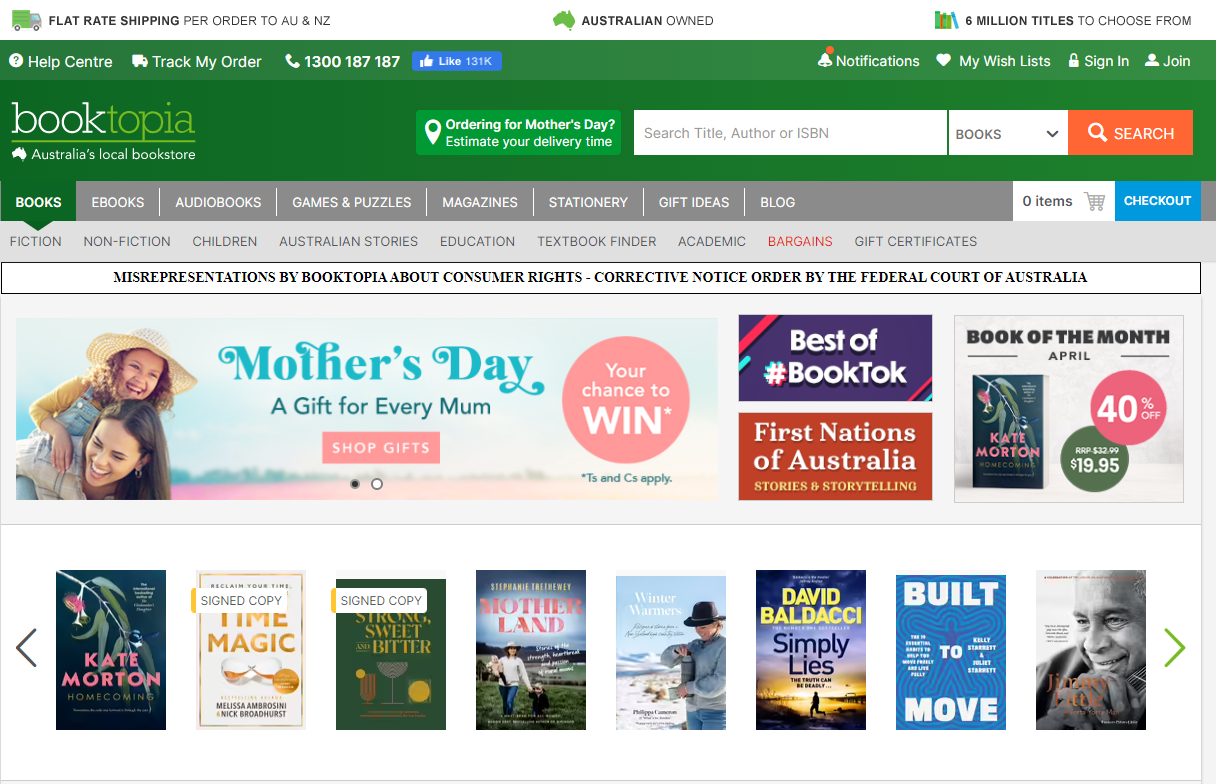

The Federal Court recently found that this is what took place within the ‘UFC Gym’ system in Australia.